Terminology used in FOAK financing by different stakeholders adds confusion and makes it difficult to recognize when essential milestones are met

Financing First-, Second-, and Third-of-a-Kind Projects involves collaboration between groups that use different terminology to describe the maturity and relative risk

Details

Core information and root causes

Context

“During the critical early deployment stages, technology risks are mostly retired. However, new risks around project development, project economics, and scaling solutions emerge. Building first, second, up to nth-of-akind projects require significant capital matched with an appetite for some risk. But very little financing is targeted at these stages. Most funds focus on early-stage investments or late-stage infrastructure opportunities, leaving mid-growth investments for climate technology largely unattended. Confusion around specific commercialization milestones adds to the challenge, with different parties using different terminology to refer to different stages of growth. The lack of clarity has obscured the specific requirements projects need to reach broadscale adoption.”

— Traversing the Climate Technology Scale Gap1

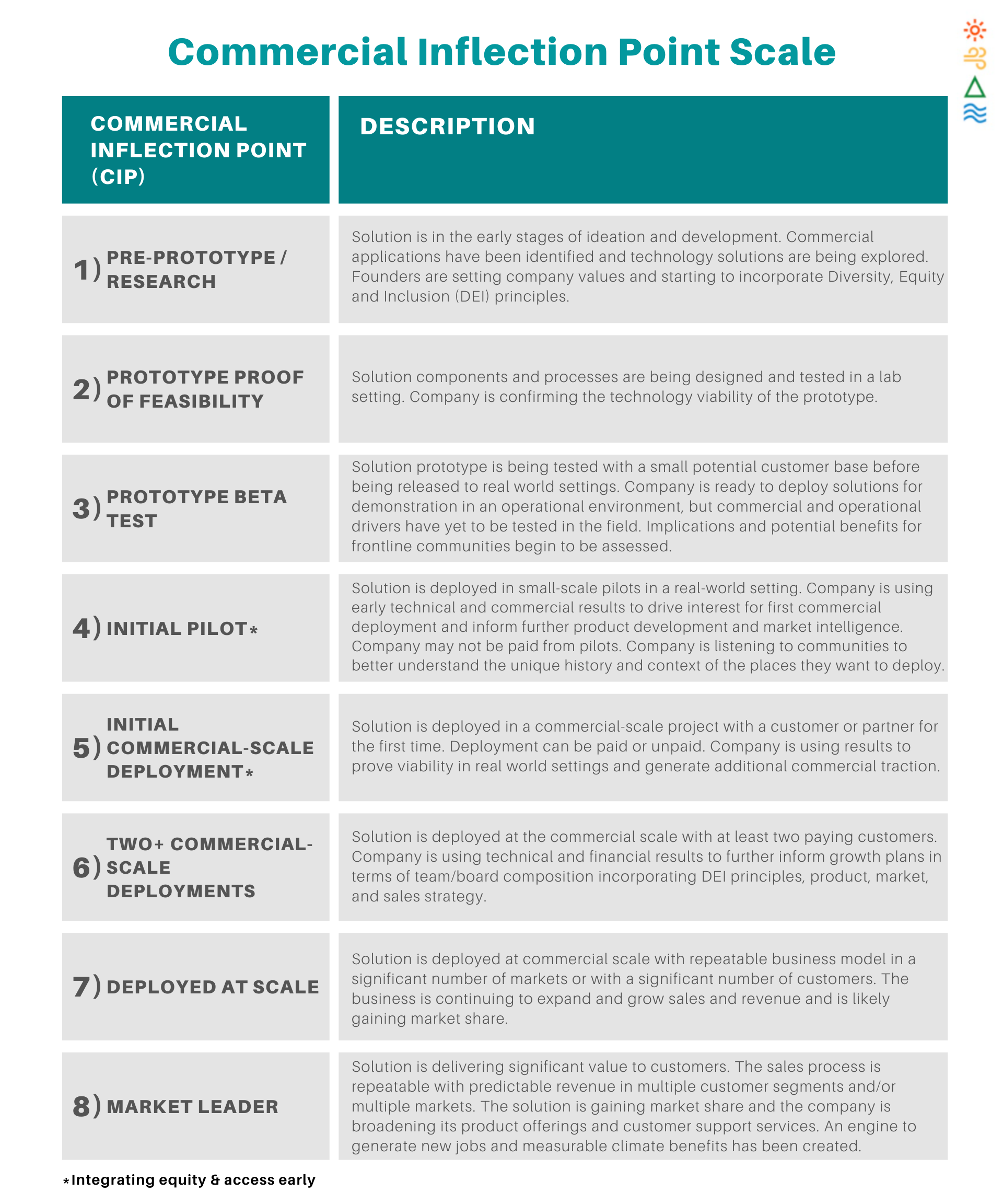

The scales most typically used in our space, such as Technology Readiness Level (TRL)—which was developed by NASA in the 1970s to determine how mature any given technology is—are used by organizations far and wide, well beyond the U.S. government. However, scales like TRL often stop at “market introduction” or “launch.”

But the launch of a product is actually only the end of the technology development cycle, and just the beginning of the commercialization journey. A major funding and expertise gap begins at TRL 9, or what we call Commercial Inflection Point 4.

This is when the really difficult work begins: deploying technology with customers in the real world. The path to scale often requires significant capital, involves numerous strategic and local partners, and calls for thoughtful, complex, and iterative deployments. What a company learns from its initial deployments informs its future trajectory, and integrating these insights into its business model and go-to-market strategy is critical for success. More times than not, our portfolio companies experience a fundamental, game-changing evolution after their first deployment.2

Groups working to address this bottleneck

- Commercial Inflection Point (CIP) Scale - Elemental Impact, 2019

- Commercial Readiness Index - ARENA (Australian Renewable Energy Agency), 2014